psm-khabarovsk.online Community

Community

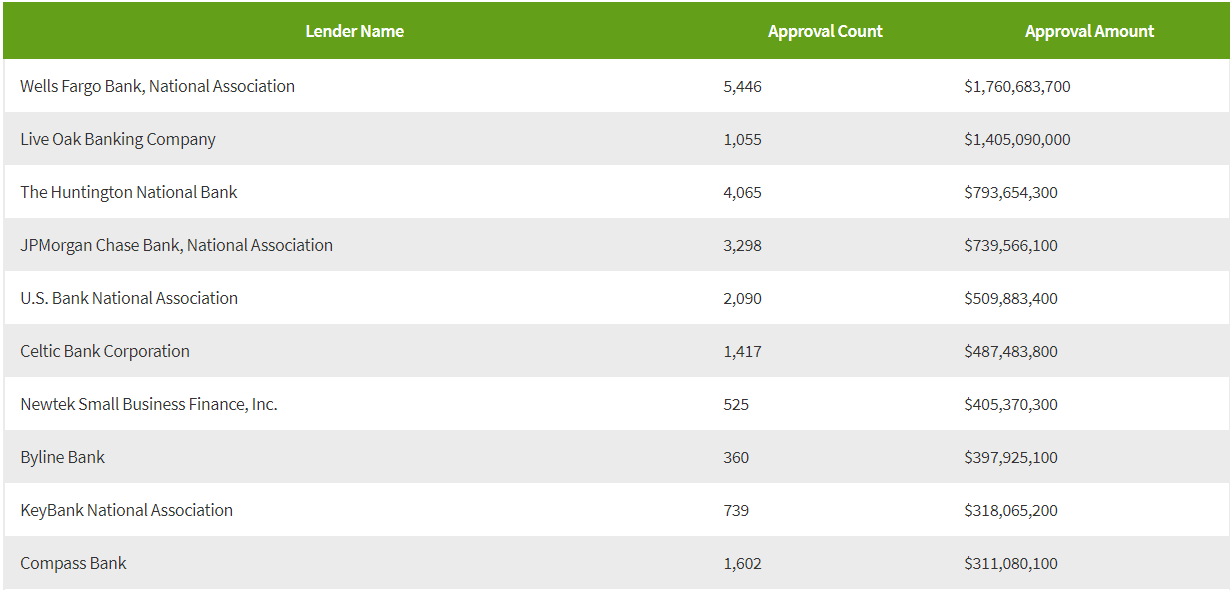

Best Sba Lenders

99 Most Active SBA 7(a) Lenders ; 3, Newtek Small Business Finance, Inc. (NY), ; 4, Readycap Lending, LLC (NJ), ; 5, Celtic Bank Corporation (UT), ; 6. The SBA Group at Citizens Business Bank delivers quick credit decisions with courteous and professional service. We understand the SBA financing process inside. Telhio is designated by the Small Business Administration (SBA) as a preferred lender. We are proud to be the #1 SBA Lender Among Credit Unions in Ohio. SBA loans provide more flexible terms, lower down payment requirements, and an easier qualification process than conventional loans. The advantage of working with a large, national bank is their experience processing loans. In most cases, large banks are well versed in SBA lending and likely. The best small business loan options for startups, small businesses and solo entrepreneurs. These loans can help you get the capital that your business needs. Best SBA Lenders for September · Best Overall: Live Oak Bank · Best for Quick & Easy Process: Funding Circle · Best for Small Loans: United Midwest Savings. Available SBA Loan Programs · Key benefits. Long-term fixed-rate financing; Loan amounts up to $5 million; Certified Development Company (CDC) loan terms up to. Newtek (terrible org, terrible pricing, but they will do any deal). · Live Oak (good shop, high pricing, doesn't do non-franchise startups unless. 99 Most Active SBA 7(a) Lenders ; 3, Newtek Small Business Finance, Inc. (NY), ; 4, Readycap Lending, LLC (NJ), ; 5, Celtic Bank Corporation (UT), ; 6. The SBA Group at Citizens Business Bank delivers quick credit decisions with courteous and professional service. We understand the SBA financing process inside. Telhio is designated by the Small Business Administration (SBA) as a preferred lender. We are proud to be the #1 SBA Lender Among Credit Unions in Ohio. SBA loans provide more flexible terms, lower down payment requirements, and an easier qualification process than conventional loans. The advantage of working with a large, national bank is their experience processing loans. In most cases, large banks are well versed in SBA lending and likely. The best small business loan options for startups, small businesses and solo entrepreneurs. These loans can help you get the capital that your business needs. Best SBA Lenders for September · Best Overall: Live Oak Bank · Best for Quick & Easy Process: Funding Circle · Best for Small Loans: United Midwest Savings. Available SBA Loan Programs · Key benefits. Long-term fixed-rate financing; Loan amounts up to $5 million; Certified Development Company (CDC) loan terms up to. Newtek (terrible org, terrible pricing, but they will do any deal). · Live Oak (good shop, high pricing, doesn't do non-franchise startups unless.

Great Lakes Credit Union, a prominent small business lender in Chicago, IL, can help you with the loan application process. Telhio is designated by the Small Business Administration (SBA) as a preferred lender The best lending solutions for your business. We are proud to be the #1. Boise, Idaho, January 17, – Bank of Idaho's SBA lending department continues to top state rankings, and is posed once again as the leader in the Boise. An SBA loan will be a better fit for companies in some industries compared to others. We encourage you to find out more about the opportunity to apply for this. Do you want to use a traditional bank to get a small business loan? Here is Bankrate's list of top picks and important details you should know. WSFS is proud to be the region's top SBA lender with a team of SBA loan relationship managers ready to partner with you. Icon of an award ribbon with a star on. The Huntington National Bank is an Equal Housing Lender and Member FDIC. The Huntington logo ®, Huntington®, The Huntington logo psm-khabarovsk.onlinee.® and. Every business is different. Find the best SBA loan structure to fit your specific situation and goals. Stearns Bank's seasoned team is happy to assist you. United Community is a SBA Preferred Lender which means we can offer the full range of SBA loan products, and have the authority to make final credit decisions. If you have a small business or are planning to start one, SBA loans can provide a comprehensive selection of financing solutions. The best bank to choose. Enterprise Bank & Trust is also a member of the National Association of Government Guaranteed Lenders (NAGGL), which allows us to best meet our clients'. Our SBA loans give you favorable options to help your small business succeed, such as flexibility in equity investment, funds for operating costs and more. Compare Best SBA Lenders August ; OnDeck · Fast And Easy Funding Process · Fast And Easy Funding Process ; Lendio · Buying, Building, or Renovating Your. Some of these loans may be applied for through the U.S. Small Business Administration (SBA), however, you can also apply for small business loans through. We're committed to helping grow small businesses into something great. As a Preferred Small Business Administration (SBA) lender, the dedicated SBA team at. Bank of Hope is one of the nation's top SBA lending banks providing SBA 7(a), SBA and SBA Express loans to help your business move forward. SBA loans are one of the most desirable and sought-after types of business loans. Many small business owners apply for SBA loans before exploring other similar. A SBA loan is an excellent option if your business has growth plans like expanding, acquiring or starting a business. Meet our SBA team and learn more. Partially guaranteed by the Small Business Administration, SBA loans provide an alternative to conventional financing for small business needs. The most common SBA loan offers flexibility on terms/uses and is a good option for acquisitions, partner buyouts, real estate purchases and refinance. Up to.

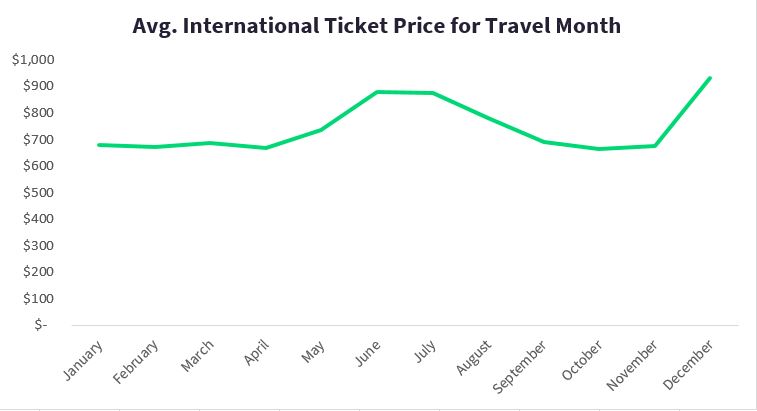

What Is The Cheapest Time To Book A Flight

Booking about one to three months in advance is typically when cheap flights have the highest likelihood of popping up. "You can typically book flights up to 12 months in advance, but those aren't the best fares." When is the best time to book a flight? Keyes recommends booking. To find the cheapest days to book a flight, it's generally best to book on weekdays, with Tuesday and Wednesday often being the least expensive. To find the cheapest fares, it's usually best to book at least a few weeks in advance for domestic flights and a few months in advance for international travel. You must have already heard that it is best to buy a flight ticket three months before your trip, or at least three weeks before. Average ticket prices tend to. Time your booking right An essential rule for finding a low airfare price is knowing when to look for it. Keyes uses what he calls “the Goldilocks window” — a. The best time to buy flights is usually weeks in advance for domestic and months for international. Prices often rise closer to. Early November is still a good month to get cheap Christmas flights. You will get your tickets almost two months in advance, which gives you peace of mind. The best time to book airfare is within a window of 21 to 74 days before you plan to fly, and the cheapest tickets are generally on mid-week flights. You can. Booking about one to three months in advance is typically when cheap flights have the highest likelihood of popping up. "You can typically book flights up to 12 months in advance, but those aren't the best fares." When is the best time to book a flight? Keyes recommends booking. To find the cheapest days to book a flight, it's generally best to book on weekdays, with Tuesday and Wednesday often being the least expensive. To find the cheapest fares, it's usually best to book at least a few weeks in advance for domestic flights and a few months in advance for international travel. You must have already heard that it is best to buy a flight ticket three months before your trip, or at least three weeks before. Average ticket prices tend to. Time your booking right An essential rule for finding a low airfare price is knowing when to look for it. Keyes uses what he calls “the Goldilocks window” — a. The best time to buy flights is usually weeks in advance for domestic and months for international. Prices often rise closer to. Early November is still a good month to get cheap Christmas flights. You will get your tickets almost two months in advance, which gives you peace of mind. The best time to book airfare is within a window of 21 to 74 days before you plan to fly, and the cheapest tickets are generally on mid-week flights. You can.

You must have already heard that it is best to buy a flight ticket three months before your trip, or at least three weeks before. Average ticket prices tend to. The Cheapest Day to Buy an International Flight is on a Thursday Believe it or not, the day on which you search for and book your international flight has a. The window for the best deals on domestic flights in the Canada is usually between three months and 30 days before departure. Time your booking right An essential rule for finding a low airfare price is knowing when to look for it. Keyes uses what he calls “the Goldilocks window” — a. Tuesdays and Wednesdays are often the best days to find deals, and flying on weekdays can also be cheaper than weekends. Additionally, using. If you know your travel plans well in advance, you could try to book when some deals might be offered, which is often when tickets are initially released. That. Domestic airfare in spring: 90 days ahead. But that's not the end the story! Now we're going to introduce you to a bunch of additional tools. Using the lesser-. Here is a little secret: the cheapest time of the year to book a flight is on any Sunday in January. When is the best month to book flights? Booking a holiday. time they book th Simply search your preferred destination and use Hopper's color-coded deals calendar to easily find the cheapest travel dates for your trip. From the US, the cheapest day to book a flight is said to be either Tuesday or Wednesday. International flights are usually cheaper on weekdays, while you will. To find the cheapest days to book a flight, it's generally best to book on weekdays, with Tuesday and Wednesday often being the least expensive. The general rule is that for domestic flights, travelers should start searching for flight tickets one to three months in advance. For international flights. Domestically and heading to Mexico, the cheapest time to fly is sometime in January or February. For places like Canada, Asia, and the South Pacific, plan your. When is the best time to book flights? For each flight and airline price patterns are different. Generally the earlier you buy plane tickets, the higher. Traveling to Hawaii during the Islands' “shoulder” months of April, May, September and October means you may find more affordable deals and less crowded beaches. When is the best time to book flights? For each flight and airline price patterns are different. Generally the earlier you buy plane tickets, the higher. The same will hold true if you travel to India in December. The Off-Season: The best and most affordable time to book flights from Toronto to Delhi is during. Booking flights in advance can help with finding the best rates on rates. · Flying midweek or on Saturdays generally yields lower fare prices while Sundays. Trying to figure out how early you should book your flight? It's possible to start comparing international airfares on Travelocity up to 12 months in advance. months, the cheapest day to fly for domestic flights is Thursday. KAYAK searches hundreds of travel sites to help you find cheap airfare and book a flight.

Freeze On All 3 Credit Bureaus

Highlights: Security freezes are now free under federal law; Freezes must be placed separately at each nationwide credit bureau; Freezes will not impact. Contact the credit bureaus. You'll need to reach out to each of the three primary credit bureaus: Equifax, Experian, and TransUnion. The quickest way is to call. If you're freezing or thawing your credit reports online, you'll simply need to log in to your accounts and go to the credit freeze management center. However. All security freezes that are requested through this portal will only be in place at LexisNexis Risk Solutions and SageStream and not other credit reporting. To place a freeze, either use each credit agency's online process or send a letter by certified mail to each of the three credit agencies. Make sure you freeze. Yes. You can freeze your TransUnion credit report with us, but to freeze your other credit reports you must contact the other bureaus, Equifax and Experian. We. 1. Sign up for a free Experian account. · 2. Place a freeze to limit access to your Experian credit file. · 3. Unfreeze or schedule a thaw any time. · 4. Get. Freezing your accounts at the three major credit bureaus is the best way to prevent thieves from opening new credit accounts in your name. Credit freezes and fraud alerts can protect you from identity theft or prevent further misuse of your personal information if it was stolen. Highlights: Security freezes are now free under federal law; Freezes must be placed separately at each nationwide credit bureau; Freezes will not impact. Contact the credit bureaus. You'll need to reach out to each of the three primary credit bureaus: Equifax, Experian, and TransUnion. The quickest way is to call. If you're freezing or thawing your credit reports online, you'll simply need to log in to your accounts and go to the credit freeze management center. However. All security freezes that are requested through this portal will only be in place at LexisNexis Risk Solutions and SageStream and not other credit reporting. To place a freeze, either use each credit agency's online process or send a letter by certified mail to each of the three credit agencies. Make sure you freeze. Yes. You can freeze your TransUnion credit report with us, but to freeze your other credit reports you must contact the other bureaus, Equifax and Experian. We. 1. Sign up for a free Experian account. · 2. Place a freeze to limit access to your Experian credit file. · 3. Unfreeze or schedule a thaw any time. · 4. Get. Freezing your accounts at the three major credit bureaus is the best way to prevent thieves from opening new credit accounts in your name. Credit freezes and fraud alerts can protect you from identity theft or prevent further misuse of your personal information if it was stolen.

The credit bureaus, however, are required to remove the freeze within three business days of receiving notice. If you are making the request on behalf of a. You will need to request a freeze with each of the three credit reporting companies. It is important to know that if you place a security freeze on your credit. Page 3. procedures for ordering. For Equifax, order by mail using the form Do I have to freeze my file with all three credit bureaus? Yes. Different. Freezing your credit file for free is simply a matter of contacting each of the three credit bureaus and requesting a freeze. Learn how to freeze your credit for free with TransUnion. Also known as a security freeze, it can help prevent new accounts from being opened in your name. To freeze your credit reports, you'll need to contact each of the three major credit bureaus: Equifax®, Experian® and TransUnion®. Credit bureaus must lift a freeze no later than three business days after receiving your request. What will a creditor who requests my file see if it is frozen? To place a credit freeze you'll need to call each of the three major credit bureaus — Experian, Equifax, and TransUnion — individually. When you make the. A credit freeze (also known as a security freeze) allows an individual to control how a consumer reporting agency (also known as a credit bureau). A security freeze prohibits, with certain exceptions, the credit reporting agency (also referred to as a consumer reporting agency or a credit bureau) from. To request a security freeze by mail, send a letter to each of the three credit bureaus listed below. Your letter should include: Your full name including. Like everyone said it's pretty straightforward, you don't need any apps if you don't want them, just create accounts on their websites and. Consumers can request a security freeze be placed on their credit report by the three major credit reporting agencies in different ways: by phone, over the. Credit report freezes are designed to prevent thieves from opening new accounts in the consumer's name. Businesses generally do not extend credit to an. A credit freeze is perhaps the most effective way of stopping identity thieves from opening new accounts in your name. Placing a credit freeze with each of the. All three credit bureaus – Equifax, TransUnion, and Experian – offer the free credit freezes. Yet, placing a credit freeze at one bureau will not carry over to. While freezing your credit makes it very hard for people to open new accounts in your name it doesn't affect any existing accounts (legitimate or fraudulent). Can cost money: Each credit bureau has a different approach to credit locks. Some offer free tools, while others charge for them. · You can't lock all credit. There is no cost to freeze or unfreeze your credit report. How to turn on the Credit Freeze: Contact each of the three major credit bureaus indicating your wish. There are no joint credit reports. Everyone has their own which means a couple would need to place six (6) security freezes (3 for one partner and 3 for the.

Single Life Annuity Death Benefit

:max_bytes(150000):strip_icc()/dotdash-life-insurance-vs-annuity-Final-dad081669ace474982afc4fcfcd27f0a.jpg)

Death benefits can be paid as a lump sum, in which the beneficiary takes the entire amount in a single payment. Alternatively, they can take the payment. A single life annuity pays you a fixed monthly income for one life. · A joint and survivor annuity allows for payments to continue to a beneficiary (or. An annuity death benefit is a feature that provides financial protection to the beneficiaries of an annuity contract by offering a lump sum payment or ongoing. You can choose from several options, all of which will provide you with a monthly benefit for life. For example, you may elect the Single Life Allowance. Pension Payment Option · Single-Life Allowance: provides the maximum pension benefit, but there is no continuing benefit to a beneficiary after you die. · Joint-. 50% joint and survivor: You receive a lower monthly payment to make sure your surviving spouse gets monthly payments for his or her life that are equal to 50%. As the name conveys, the benefit is for both of you and will continue to be paid out to the survivor when one of you dies. If you die before receiving benefits for 10 years, your designated beneficiary will be eligible for a benefit. If your beneficiary is an individual, the. Single life payments stop at the annuitant's death. For joint life, if one annuitant dies, the payments continue to the survivor for the rest of his or her life. Death benefits can be paid as a lump sum, in which the beneficiary takes the entire amount in a single payment. Alternatively, they can take the payment. A single life annuity pays you a fixed monthly income for one life. · A joint and survivor annuity allows for payments to continue to a beneficiary (or. An annuity death benefit is a feature that provides financial protection to the beneficiaries of an annuity contract by offering a lump sum payment or ongoing. You can choose from several options, all of which will provide you with a monthly benefit for life. For example, you may elect the Single Life Allowance. Pension Payment Option · Single-Life Allowance: provides the maximum pension benefit, but there is no continuing benefit to a beneficiary after you die. · Joint-. 50% joint and survivor: You receive a lower monthly payment to make sure your surviving spouse gets monthly payments for his or her life that are equal to 50%. As the name conveys, the benefit is for both of you and will continue to be paid out to the survivor when one of you dies. If you die before receiving benefits for 10 years, your designated beneficiary will be eligible for a benefit. If your beneficiary is an individual, the. Single life payments stop at the annuitant's death. For joint life, if one annuitant dies, the payments continue to the survivor for the rest of his or her life.

Upon one spouse's death, the survivor will continue to receive payments for life.2 Those payments, or joint life payouts, can be the same amount the. Lump Sum Benefit If a former employee dies and no survivor annuity is payable, the retirement contributions remaining to the deceased person's credit in the. Some annuities come with optional riders that provide enhanced death benefits. These riders can increase the payout to beneficiaries, similar to life insurance. Every annuity has a beneficiary designation with a death beneficiary, which should be fairly simple to interpret. In most cases the death beneficiary is. Learn about the death benefits that can be provided if a member dies after buying an annuity contract, and the resulting taxes payable. A single life annuity is an annuity that provides an income as long as the annuitant is living. When the annuitant dies, the contract ceases unless it. This section explains the death benefits for the Life Annuity options. For The best option for you is the one that meets your individual needs. The. Pension Payment Option · Single-Life Allowance: provides the maximum pension benefit, but there is no continuing benefit to a beneficiary after you die. · Joint-. A joint-and-survivor annuity provides a benefit for the rest of your life at an amount reduced from the straight-life annuity amount, with your choice of 50%. The Survivor Benefit Plan (SBP) allows a retiree to ensure, after death, a continuous lifetime annuity for their dependents. Death benefit: The annuity benefits paid to the beneficiary upon the death of the contract owner or annuitant. Fixed annuity: An annuity contract guarantees. If you are not married at the time benefits are to be paid from the plan, your benefit is paid in the form of a single-life annuity unless you make a valid. (The joint and survivor annuity benefits paid to you during your life will be smaller than if you elected a single life annuity, because they are payable as. Joint and survivor annuities. The first annuitant receives a definite amount at regular intervals for life. After they die, a second annuitant receives a. Once both spouses die, there is no death benefit for beneficiaries. On the other hand, a single life annuity with a year guarantee pays out to you alone for. This death benefit ensures that the invested funds pass on to heirs, providing financial support even after the annuity owner's death. Get an Annuity Quote. Types of Survivor Benefits that may be payable by OPM · Monthly Annuity · Lump-Sum Credit · Basic Employee Death Benefit (FERS ONLY). If your annuity has death benefits, it's always best to name a beneficiary in an annuity contract when you purchase it. If you don't, the annuity will still get. Once both spouses die, there is no death benefit for beneficiaries. On the other hand, a single life annuity with a year guarantee pays out to you alone for. Certain single life options—“cash refund” and “ten-year certain”—provide for a beneficiary who may receive payment(s) after your death. These options are.

Is Glaxosmithkline A Good Stock To Buy

Stocks in Translation · NEXT · Lead This Way · Good Buy or Goodbye? ETF Report · Financial Freestyle · Capitol Gains · Living Not So Fabulously · Decoding. The intrinsic value of one GSK stock under the Base Case scenario is USD. Compared to the current market price of USD, GlaxoSmithKline PLC is. It currently has a Growth Score of C. Recent price changes and earnings estimate revisions indicate this would not be a good stock for momentum investors with. GSK plc is listed on NYSE under GSK. You can buy GSK plc stock through any online brokerage account such as E*TRADE, Charles Schwab, or Merrill Edge. Premium. GSK plc GSK:NYSE · Open · Day High · Day Low · Prev Close · 52 Week High · 52 Week High Date05/15/24 · 52 Week Low · 52 Week Low Date11/ GlaxoSmithKline Share Price: Find the latest news on GlaxoSmithKline Stock Price Stock with consistent financial performance, quality management, and strong. In the current month, GSK has received 5 Buy Ratings, 2 Hold Ratings, and 1 Sell Ratings. GSK average Analyst price target in the past 3 months is $ GSK Plc is a healthcare company, which engages in the research, development, and manufacture of pharmaceutical medicines, vaccines, and consumer healthcare. Algorithm-based forecast service WalletInvestor estimated that GSK price could stabilise over the next couple of years and then edge lower over the longer term. Stocks in Translation · NEXT · Lead This Way · Good Buy or Goodbye? ETF Report · Financial Freestyle · Capitol Gains · Living Not So Fabulously · Decoding. The intrinsic value of one GSK stock under the Base Case scenario is USD. Compared to the current market price of USD, GlaxoSmithKline PLC is. It currently has a Growth Score of C. Recent price changes and earnings estimate revisions indicate this would not be a good stock for momentum investors with. GSK plc is listed on NYSE under GSK. You can buy GSK plc stock through any online brokerage account such as E*TRADE, Charles Schwab, or Merrill Edge. Premium. GSK plc GSK:NYSE · Open · Day High · Day Low · Prev Close · 52 Week High · 52 Week High Date05/15/24 · 52 Week Low · 52 Week Low Date11/ GlaxoSmithKline Share Price: Find the latest news on GlaxoSmithKline Stock Price Stock with consistent financial performance, quality management, and strong. In the current month, GSK has received 5 Buy Ratings, 2 Hold Ratings, and 1 Sell Ratings. GSK average Analyst price target in the past 3 months is $ GSK Plc is a healthcare company, which engages in the research, development, and manufacture of pharmaceutical medicines, vaccines, and consumer healthcare. Algorithm-based forecast service WalletInvestor estimated that GSK price could stabilise over the next couple of years and then edge lower over the longer term.

So, Which Is the Better Investment, Pfizer Inc or GSK plc (ADR) Stock? Overall, Pfizer Inc stock has a Value Score of 49, Growth Score of 90 and Momentum Score. GSK's RSV Vaccine Is a Blockbuster After Just 4 Months. The Stock Is Up. Jan. 16, a.m. ET. 4 Pharma Stocks to Buy, According to an Analyst. Novo. GSK is quoted on the London and New York stock exchanges. The company's shares are listed on the New York Stock Exchange in the form of American Depositary. Morningstar's 10 "best stocks to buy now" are the most undervalued among its "best companies to own." CMCSATSMWFRHHBY. GSK stock could be a bargain. Is GSK a Strong Buy Right Now? George Budwell | Jun 26, The drugmaker ought to appeal to value and income investors. We continue to view the stock as undervalued, with the market not fully appreciating GSK's growth potential and overly concerned about Zantac litigation that. View analyst opinion as to whether the stock is a strong buy, strong sell or hold, based on analyst Month GSK price targets. Created with Highcharts The company is under pressure with slow growth and cost-cutting, but has a good dividend yield and strong cashflow. The key concern is the company's drug. GlaxoSmithKline is a drug manufacturers - general business based in the US. GlaxoSmithKline shares (GSK) are listed on the NYSE and all prices are listed in. According to 5 analysts, the average rating for GSK stock is "Buy." The 12 India's GlaxoSmithKline Pharma posts higher Q1 adjusted profit on strong demand. Algorithm-based forecast service WalletInvestor estimated that GSK price could stabilise over the next couple of years and then edge lower over the longer term. GSK Stock Overview · Trading at % below our estimate of its fair value · Earnings are forecast to grow % per year · Trading at good value compared to. There are 1 analysts who have given it a strong buy rating & 1 analysts have given it a buy rating. Is Glaxosmithkline Pharmaceuticals a good stock to invest. Buy Rating on GlaxoSmithKline (GSK) September 3, TipRanks. European Great West Road. Brentford. TW8 9GS. United Kingdom. psm-khabarovsk.online The GSK share price has fallen by 14% in the past year, compared with a 1% rise in the FTSE Index (UK), a 38% gain for UK rival Astrazeneca (AZN) and a. GLAXOSMITHKLINE ORD, THE INCOME SHARE: As we needed a good income stock, we have managed to buy into GSK at a reasonable price with a B/E of of course. GSK has received a consensus rating of Moderate Buy. The company's average rating score is , and is based on 5 buy ratings, 1 hold rating, and 1 sell rating. Stock exchange announcements. Investors Stock exchange announcements · London Registered office: Great West Road, Brentford, Middlesex, TW8 9GS, United. This page provides details of GSK's share price for stocks quoted on both the London and New York Stock Exchanges. Registered office: Great West Road. GSK Stock Gains % Year to Date: Time to Buy, Sell or Hold? Zacks Investment Research • Thursday.

Kanban Inventory System

The Kanban system enables production to be controlled using a visual system that generates production orders that meet actual consumption. A simple and. Kanban is a system that schedules lean manufacturing. It controls the supply chain to realize cost savings through implementing the just-in-time inventory. The Kanban inventory management system is a lean inventory control system widely used in just-in-time manufacturing. Kanban is an inventory scheduling system that allows companies to stock only needed components and arts in the production or distribution process. BlueBin Kanban System for Healthcare · Most Efficient, Reliable Way To Deliver Supplies · Guaranteed Performance · 2-Bin Kanban Inventory Management System · Ready. Is your inventory right-sized? SyncKanban® software is an eKanban or electronic manufacturing Kanban system that keeps automated, instantaneous supply chain. eTurns TrackStock SensorBins is an inventory management system that relies on real-time point-of-use inventory consumption (usage) to trigger replenishment . Kanban is a scheduling system for lean manufacturing Taiichi Ohno, an industrial engineer at Toyota, developed kanban to improve manufacturing efficiency. I see a lot of videos where companies are using a kanban board to order parts and such to ensure inventory is flowing. The Kanban system enables production to be controlled using a visual system that generates production orders that meet actual consumption. A simple and. Kanban is a system that schedules lean manufacturing. It controls the supply chain to realize cost savings through implementing the just-in-time inventory. The Kanban inventory management system is a lean inventory control system widely used in just-in-time manufacturing. Kanban is an inventory scheduling system that allows companies to stock only needed components and arts in the production or distribution process. BlueBin Kanban System for Healthcare · Most Efficient, Reliable Way To Deliver Supplies · Guaranteed Performance · 2-Bin Kanban Inventory Management System · Ready. Is your inventory right-sized? SyncKanban® software is an eKanban or electronic manufacturing Kanban system that keeps automated, instantaneous supply chain. eTurns TrackStock SensorBins is an inventory management system that relies on real-time point-of-use inventory consumption (usage) to trigger replenishment . Kanban is a scheduling system for lean manufacturing Taiichi Ohno, an industrial engineer at Toyota, developed kanban to improve manufacturing efficiency. I see a lot of videos where companies are using a kanban board to order parts and such to ensure inventory is flowing.

Our kanban system is focused on keeping your parts fully stocked and easily available for your employees to access, especially with our CPS®KANBAN multi-bin. Kanban is a visual scheduling system for lean inventory and lean manufacturing also called just-in-time (JIT) inventory/ manufacturing. Taiichi. Ohno, an. Kanban utilizes simple visual signals instead of sophisticated software systems to trigger production or replenishment. These visual signals can be designed in. Kanban is considered a “lean production” technique, or one that eliminates labor and inventory waste. As discussed above, PPCS is one of the. Benefits of Kanban system to manage medical inventory in hospitals · Stock outs and stock surpluses · Better inventory tracking and stock control · Reduced. Kanban boards and invest in an inventory management system. Katana's live inventory management software provides real-time data about your stock levels. QSight Kanban is a two-bin solution to manage the inventory of consumables in procedural areas of hospitals. It uses visual cues to inform when to order. The Supply Chain Management Software for lean management of material flows in Procurement, Production, and Logistics. KanbanBOX is the first solution developed. The Kanban system functions on the basis that a company restocks or replenishes its coffers with materials only when it is needed. The Kanban principle has proven to be an extremely efficient system for inventory management and production control. In the healthcare sector. Kanban can be used to align inventory with actual customer demand. Store owners can use Kanban to trigger replenishment depending on a threshold. Kanban inventory is a system of lean manufacturing where production happens with the least amount of inventory. Instead of stocking huge amounts of inventory, a. The kanban inventory system is a visual management method, originating from Toyota's production system, designed to control and optimize the flow of goods. Inventory management is critical for companies that sell goods and products. Too little and they lose sales, yet too much can be wasteful and tie up capital. The Kanban system is designed to improve resource allocation and management by minimizing the volume of materials kept in inventory. This is achieved by. Can anyone explain how and why we calculate number or Kanban cards required in a pull system inventory info etc. the key info is max. Settings · Integrated to the venerable Helios™ Harmony Console System · Connected to Hospital Information Systems providing ongoing,near real-time inventory and. The goal of a Kanban pull system is to create a smooth and efficient workflow, minimize inventory, and reduce lead times. Nowadays, the Kanban pull system is. Lastly, we will illustrate the system with inventory management typically found in the manufacturing world, versus a Kanban system without inventory in areas. Kanban inventory system in health care industry. The method of replenishment under Kanban inventory system is discussed with the help of simple example. The.

Pip In Forex Trading

A pip, also known as a "point" in currency trading, is worth 1/th of one cent on most exchanges. Forex traders typically use pips to calculate profits and. Pip is an abbreviation for point in percentage and the smallest change in value a currency (or the exchange rate between the two currencies) can make. A pip or percentage in point is how currency price movements are often quoted. In most cases, a pip refers to the fourth decimal point of a price change. In the currency market, pips refer to the smallest incremental price movement that determines the value of a currency pair. In forex trading, the unit of measurement to express the change in value between two currencies is called a "pip.". A lot is a number of currency units. A standard lot equal to , units of a base currency/your account currency. It means that if you want to trade EUR/USD. Pip stands for 'percentage in point'. A pip in forex trading is the smallest standardized move by which a current quote can change. To calculate a pip's value in the forex market, you must take into account the currency pair you are trading and the exchange rate. For example, if you were. A pip, an acronym for percentage in point or price interest point, is a tool of measurement related to the smallest price movement made by any exchange rate. A pip, also known as a "point" in currency trading, is worth 1/th of one cent on most exchanges. Forex traders typically use pips to calculate profits and. Pip is an abbreviation for point in percentage and the smallest change in value a currency (or the exchange rate between the two currencies) can make. A pip or percentage in point is how currency price movements are often quoted. In most cases, a pip refers to the fourth decimal point of a price change. In the currency market, pips refer to the smallest incremental price movement that determines the value of a currency pair. In forex trading, the unit of measurement to express the change in value between two currencies is called a "pip.". A lot is a number of currency units. A standard lot equal to , units of a base currency/your account currency. It means that if you want to trade EUR/USD. Pip stands for 'percentage in point'. A pip in forex trading is the smallest standardized move by which a current quote can change. To calculate a pip's value in the forex market, you must take into account the currency pair you are trading and the exchange rate. For example, if you were. A pip, an acronym for percentage in point or price interest point, is a tool of measurement related to the smallest price movement made by any exchange rate.

In most cases, a pip refers to the fourth decimal point of a price that is equal to 1/th of 1%.

In foreign exchange markets, a percentage in point (pip) is a unit of change in an exchange rate of a currency pair. A pip is the smallest whole unit price. A pip, short for percentage in point or price interest point, is the smallest numerical price move in the exchange market. The pip value when forex trading affects how much you will make or lose, in your own currency, for each pip the price moves. Pip value is based on the lot. A pip is the smallest price increment (fraction) tabulated by currency markets to establish the price of a currency pair. A pip is essentially the smallest move that a currency could make in the forex market and it is an important unit of measurement in currency trading. In most cases, a pip refers to the fourth decimal point of a price that is equal to 1/th of 1%. Pips in forex trading represent a one-digit movement that's seen in the fourth decimal place of a FX pair's price. Pip is short for 'point in percentage'. Summary · A pip is a unit of measure for price movements in foreign exchange (“forex” or “FX”) markets. · Most commonly in FX market convention, pricing. Pips in Forex · Role in Forex trading: Pips are used to measure the amount of change in the exchange rate for a currency pair. · Standard value: For most. To calculate pip value, divide one pip (usually ) by the current market value of the forex pair. Then, multiply that figure by your lot size, which is the. Pip calculators explained. A 'Pip', short for 'point in percentage', quantifies exchange rate movements between two currencies in Forex trading. A pip is a measurement of movement in forex trading, used to define the change in value between two currencies. Pip literally means point in percentage. So it's equivalent to 1/ of 1%. If EUR/USD moves from to , for example, it has gone up five pips. In currency pairs that include the Japanese. A pip in Forex stands for Price Interest Point and is a fractional measure of the exchange rate movement. Pips in Forex Trading – Everything You Need to Know · Pip value = ( / Exchange rate) x Position size · ( / ) x , = $ per pip · Lot. A pip is the smallest value change in a currency pair's exchange rate. In forex trading, since currency prices typically move in tiny increments, they are. A forex pip is the smallest price movement in a currency pair. Typically, one pip represents a change in the exchange rate for most currency pairs. It is. A pip is the unit of measurement for the change of value in the exchange rate of two currencies. For currency pairs with 4 decimals, 1 pip = “Pips” is a word folks use a lot in finance trading, especially in forex. It means the slightest movement in the price of a currency pair. How to calculate the value of a pip? Depending on your account base currency, you would need to convert the pip value accordingly. For example, the pip.

The Hot Penny Stocks

As the name suggests, these stocks are often priced under $2 per share — making them much more accessible to new penny stock investors or those with less. The best stock tracker for penny stocks. With the penny stock market, you get education, innovation, and support that helps you simplify investing and learn. Many penny stocks are from new companies with a micro market cap of under $ million. You can search here for analysts' top-rated penny stocks. Find our top penny stocks here and learn how to take a position on them in the UK through trading or investing. These shares have been selected for their. Quickly track today's top cheap stocks in the market. Browse our most active penny stocks list to see which low priced stocks gamblers are rolling the dice on. Hot penny stocks from psm-khabarovsk.online have made record setting gains. Their penny stock picks over the last month have gone on to make readers potential. Company profiles of today's most active penny stocks priced under $5 with quotes, charts, and technical analysis. When you sign up, you'll receive: A handful of stocks are flashing breakout signals and technical strength right now. Get this free list of small-cap stocks. We've collected a NYSE and NASDAQ list of penny stocks under $1 and sorted them based on Zen Score, so you can find the best penny stocks based on their. As the name suggests, these stocks are often priced under $2 per share — making them much more accessible to new penny stock investors or those with less. The best stock tracker for penny stocks. With the penny stock market, you get education, innovation, and support that helps you simplify investing and learn. Many penny stocks are from new companies with a micro market cap of under $ million. You can search here for analysts' top-rated penny stocks. Find our top penny stocks here and learn how to take a position on them in the UK through trading or investing. These shares have been selected for their. Quickly track today's top cheap stocks in the market. Browse our most active penny stocks list to see which low priced stocks gamblers are rolling the dice on. Hot penny stocks from psm-khabarovsk.online have made record setting gains. Their penny stock picks over the last month have gone on to make readers potential. Company profiles of today's most active penny stocks priced under $5 with quotes, charts, and technical analysis. When you sign up, you'll receive: A handful of stocks are flashing breakout signals and technical strength right now. Get this free list of small-cap stocks. We've collected a NYSE and NASDAQ list of penny stocks under $1 and sorted them based on Zen Score, so you can find the best penny stocks based on their.

Are you looking to diversify your portfolio with promising penny stocks? Take a look at these NYSE penny stocks that are going strong in the market. The term penny stock refers to any stock that is traded outside one of the major exchanges. The definition of a penny stock is a low priced speculative. The best place to start looking for hot OTC stocks is with Scanz's Breakouts module. Simply limit the markets filter to OTC Markets and select your filter. This page provides a list of penny stocks (those trading between and ) sorted by the highest 5-day percent change. These high-volatility stocks. Best penny stocks · iQIYI Inc. (IQ). · Geron Corp. (GERN). · psm-khabarovsk.online (TBLA). · Archer Aviation Inc. (ACHR). · Navitas Semiconductor Corp. (NVTS). · Nuvation. Canadian and USA Penny Stocks and small cap info, quotes, news, charts, most actives, weekly North American market information, portfolio management tools. Best UK penny stocks to watch · Shoe Zone · Kodal Minerals · Harland & Wolff · DG Innovate · Abingdon Health · Poolbeg Pharma · Golden Metal Resources · Ondo InsurTech. Normally, a penny stock goes through a pump and dump so the short interest was taken at a higher price - not a lower price. million short shares is only. Find the latest news about PENNY STOCKS. View the PENNY STOCKS news and updates for today, Investment news based on TipRanks market-leading research tools. Hot penny stocks are low-priced equities, typically under $5 per share, known for their high volatility and potential for substantial price. Penny stocks trade at $5 or less per share — they're cheap but sketchy! Check out my list of the hottest ones in Robinhood traders' sights. Researching all the penny stocks and giving alerts on the ones that are due to make you rich! Email [email protected] to get subscribed! Best Penny Stocks ; HUIZ, ; AEHL, ; SHIM, ; IONR, Penny Stocks ; Paras Petrofils, ₹, ; BKM Industries, ₹, ; Ramgopal Polytex, ₹, ; Teamo Productions HQ, ₹, Stock Screener Stock Ideas Volatile Penny Stocks. Most Volatile Penny Stocks Today. A list of the most volatile penny stocks listed on the NYSE or NASDAQ. Penny Stocks App for android is use to find hot penny stocks ideas and top penny stocks today. Penny Stock Screener allows a trader to find daily top penny. Penny stocks app to find the best penny stocks to trade throughout the day. Penny stock screener to search for hot NASDAQ penny stocks. Penny Stocks App for. Penny stocks are regarded as a more speculative investment than larger businesses because they are geared for growth and often loss-making. The Bottom Line. Penny stocks refer to shares in companies with a low price and low trading volume. Because these markets have low liquidity, there is also high. The penny stock will trade sideways on a higher-than-average volume, which is a bullish indicator for the future of the shares. The stocks will reach a tipping.

What Is A Term Deposit

:max_bytes(150000):strip_icc()/timedeposit.asp-final-086fbc5d88c24721bc1e3ea2f3de8270.jpg)

A Term Deposit offers flexible tenure and has minimum deposit requirements while a Fixed Deposit has a longer tenure and offers benefits of compound interest. When interest rates are fluctuating, you may be looking for ways to make the most of your savings. An investment technique to consider is term deposit. A term deposit is a deposit with a specific maturity date. The Term Deposit Facility was established to facilitate the conduct of monetary policy by providing a. A Term Deposit is a form of investment where you deposit money into a financial institution for a set period of time. In return you earn a fixed interest rate. Term deposits are a type of savings account where you invest your money for a fixed period of time, from as little as one month to as long as five years. Term deposits are time deposit schemes where you invest money with a financial institution for a fixed duration. Term deposits are a safe way to lock away money. But you could earn more by investing it elsewhere. You may be able to earn more money by investing in property. A term deposit is a risk-free, no-nonsense way to earn high interest on your savings. With it, you simply select the amount you'd like to save. With a term deposit, you lock away an amount of money for an agreed length of time (the 'term') – that means you can't access the money until the term is up. A Term Deposit offers flexible tenure and has minimum deposit requirements while a Fixed Deposit has a longer tenure and offers benefits of compound interest. When interest rates are fluctuating, you may be looking for ways to make the most of your savings. An investment technique to consider is term deposit. A term deposit is a deposit with a specific maturity date. The Term Deposit Facility was established to facilitate the conduct of monetary policy by providing a. A Term Deposit is a form of investment where you deposit money into a financial institution for a set period of time. In return you earn a fixed interest rate. Term deposits are a type of savings account where you invest your money for a fixed period of time, from as little as one month to as long as five years. Term deposits are time deposit schemes where you invest money with a financial institution for a fixed duration. Term deposits are a safe way to lock away money. But you could earn more by investing it elsewhere. You may be able to earn more money by investing in property. A term deposit is a risk-free, no-nonsense way to earn high interest on your savings. With it, you simply select the amount you'd like to save. With a term deposit, you lock away an amount of money for an agreed length of time (the 'term') – that means you can't access the money until the term is up.

Term deposits are a type of savings account that lets you invest funds for a specific term at a fixed interest rate. Interest is calculated daily and paid. TERM DEPOSIT definition: an arrangement with a bank in which you have an account that pays interest, usually with money left. Learn more. You can choose to reinvest your money into a new term deposit, either with or without the interest you've earned. You can also choose to add more money and open. A term deposit is a fixed-term investment, including the deposit of money at a financial institution in an account. Term deposits let you invest for a set amount of time and get a fixed interest rate. They can be useful when saving for bigger items like a car or investing. Lloyds Bank Fixed Term Deposit gives you a fixed interest rate on savings between £ and £5 million. Steps to Participate in the Term Deposit Facility, Interest Earnings Calculations and Payments, Settlements, and Maturities, Term Deposits as Collateral. When you open a term deposit account, your money is invested at an agreed fixed interest rate for a fixed period of time (the 'term'). That means, once you've. A term deposit is a cash investment with a guaranteed return and generally offered at a fixed interest rate over a set period (the term). This article will be your one-stop guide to understanding term deposits, including how they work, their pros and cons, and how to choose the right one for you. A fixed term deposit, also known as FTD, is a financial product through which an individual (natural person) or a company (legal entity) deposits an amount of. A time deposit is an interest-bearing bank account that has a specific date of maturity, such as a certificate of deposit (CD). Get to know the difference between term deposit and fixed deposit here on Groww. Check their respective meaning, benefits, and process to invest here in. The interest rate attached to short-term deposits is usually lower than longer tenors. The usual interest rate offered for seven to 30 days ranges between 4%-5%. A term deposit implies that you agree to leave your money with the bank for a specific period of time. This doesn't mean that you can't withdraw it before the. A time deposit or term deposit is a deposit in a financial institution with a specific maturity date or a period to maturity, commonly referred to as its. If you want to access money in your term deposit, you'll need to give us 31 days' notice and pay a fee, and the interest you earn will be adjusted (so you'll. In the UK, a term deposit is normally called a fixed term deposit or a fixed rate bond. A term deposit account offers competitive fixed interest rates that don'. Term Deposits can play an important role in an investment portfolio - they offer security and flexibility. Rates & fees % p.a. % p.a. % p.a. % p.a. % p.a. % p.a. % p.a. % p.a. % p.a. % p.a. The above Term.

How To Trade Futures On Tastyworks

Futures work by locking in the current market price and setting it as the fixed price at which an underlying asset will be exchanged later on. At the future. Users can now trade crypto along with stocks, options, and futures. Twenty-two coins are available to trade! You can find more information here. With how. How to Trade Futures · Do your research to get an understanding of how futures trading works · Create an account or log in · Choose your preferred market and. TastyWorks is a fun broker to trade Options with and you have the ability to trade equities beyond the U.S. markets. They are reliable with a mobile and online. Futures are traded overnight, which makes trading them unique. See common strategies futures traders use in our Learn Center: psm-khabarovsk.online May. Don't trade with money you can't afford to lose. This website is neither a solicitation nor an offer to Buy/Sell futures or options. No representation is. With tastytrade, you can trade a range of futures options across asset classes. Plus, you can utilize mini, micro, and Smalls futures options, which enable. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not. Ideally what you want to do is paper trade futures before trading real money. This is something Tasty does not offer. You can try other brokers/resources to. Futures work by locking in the current market price and setting it as the fixed price at which an underlying asset will be exchanged later on. At the future. Users can now trade crypto along with stocks, options, and futures. Twenty-two coins are available to trade! You can find more information here. With how. How to Trade Futures · Do your research to get an understanding of how futures trading works · Create an account or log in · Choose your preferred market and. TastyWorks is a fun broker to trade Options with and you have the ability to trade equities beyond the U.S. markets. They are reliable with a mobile and online. Futures are traded overnight, which makes trading them unique. See common strategies futures traders use in our Learn Center: psm-khabarovsk.online May. Don't trade with money you can't afford to lose. This website is neither a solicitation nor an offer to Buy/Sell futures or options. No representation is. With tastytrade, you can trade a range of futures options across asset classes. Plus, you can utilize mini, micro, and Smalls futures options, which enable. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not. Ideally what you want to do is paper trade futures before trading real money. This is something Tasty does not offer. You can try other brokers/resources to.

The Initial or Overnight Margin requirement for a given Futures contract is set by the exchange on which the Futures contract trades. However, tastyworks, Inc. Open the Mac App Store to buy and download apps. tastytrade: Invest & Trade 4+. Trade Options, Futures, Stocks. tastyworks. Designed for iPad. • K. The Small Exchange is making futures markets more accessible to more people. Our innovative futures products are small, standard, and simple. trading platform. So, getting a Tastytrade brokerage account will give you access to sell stocks, options, futures, and other equities. There are a lot of. The futures application comprises of four parts: Futures Trading Experience, Additional Futures Questions, Important Documents, and Agreements. tastytrade Inc. (previously known as tastyworks One of the oldest ways to trade, commodity futures include agriculture, livestock, and other products. Open the Mac App Store to buy and download apps. tastytrade: Invest & Trade 4+. Trade Options, Futures, Stocks. tastyworks. Designed for iPad. • 52 Ratings. Investors can speculate on the direction of a futures contract by going long (buy to open) or short (sell to open) a futures contract. futures and an options on futures trade on the tastyworks platform futures and an options on futures trade on the tastyworks platform. Furthermore, the margin account must satisfy the overnight requirement to trade outright futures contracts. On the other hand, options on futures are subject to. Ideally what you want to do is paper trade futures before trading real money. This is something Tasty does not offer. You can try other brokers/resources to. Master all of the intricacies of futures that distinguish them from other trading instruments and make them valuable in your portfolio. A futures trading platform for the active trader. tastyworks has one of the lowest commission rates in the futures brokerage industry - $/contract (plus. Stocks. Options. Futures. More. Get the trading platform that lets you take control of your investing, from the broker that does things better: tastytrade. Are you looking to trade futures and wondering which CME futures contracts you can trade at tastytrade? was formerly known as tastyworks, Inc. © To trade or look up a quote of a back month contract (further in time), type the month and year code. You need to have a minimum of $25, in your account before starting to day trade on any given day; PDT rules don't apply to futures trading or crypto trading. You agree that tastytrade's margin requirement for all outright Futures will be held at a minimum of one hundred twenty-five percent (%) of the Exchange. I have the works level of account approval which seems to grant me the ability to trade futures. When I attempt to place a futures trade it. Free online trading for stocks and ETFs. · $1 per options contract on stocks and ETFs to open, zero to close. · $ per contract on options on micro futures to.